NXG NextGen Infrastructure Strategy

What Is NextGen / Overview / Quick Facts / Positioning / Portfolio Managers / Investment Vehicles / Materials

The Evolution of Infrastructure

The infrastructure investment landscape is rapidly evolving due to technological advancements, sustainable infrastructure, and renewable energy. These coupled with the critical need for traditional infrastructure make a compelling combination we call NextGen.

What Is NextGen Infrastructure

Infrastructure investment landscape is rapidly evolving due to technological advancement and obsolescence across all sectors

Some traditional growth infrastructure companies are now in their maturity phase (e.g. coal plants)

We believe many traditional infrastructure companies will become leaders in implementing technological innovations

Emerging companies that historically may not have been considered infrastructure are becoming the backbone of the new economy

We believe investing in NextGen infrastructure provides opportunities for attractive risk-adjusted returns of the next several decades

Investment Opportunity

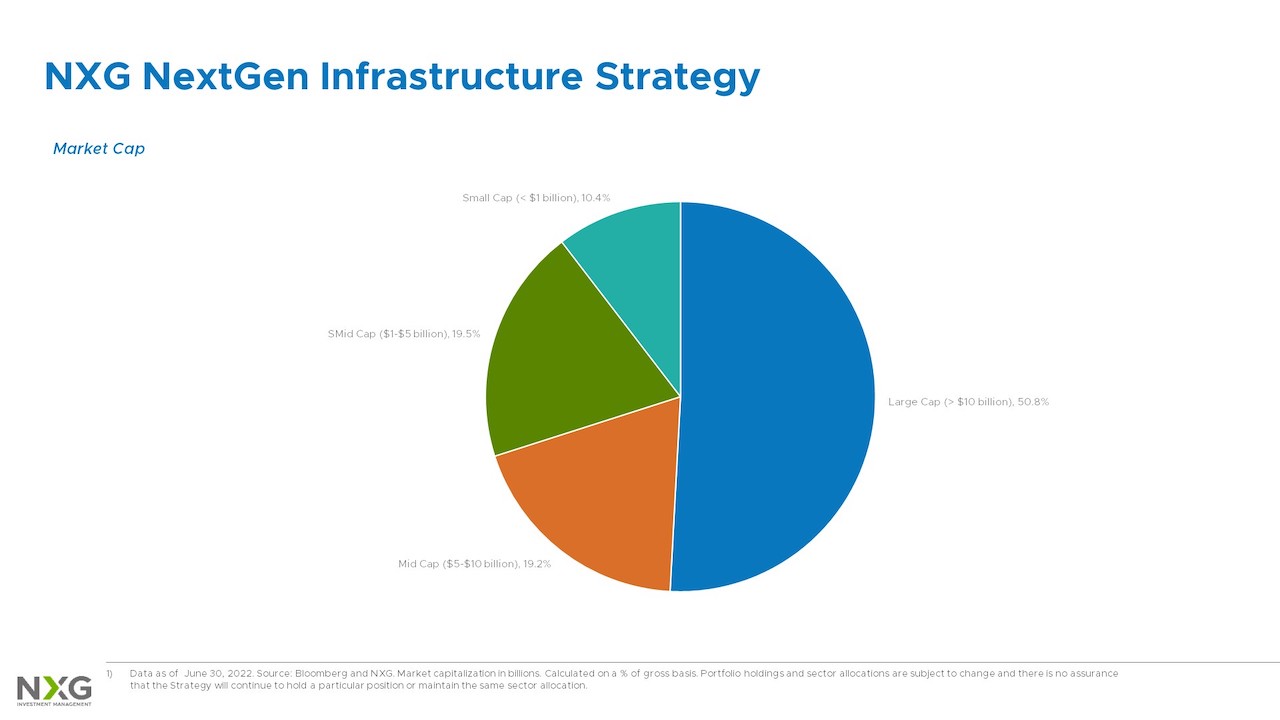

Companies meeting our definition of NextGen infrastructure have a combined market cap of over $17 trillion, providing a range of opportunities

Global data is doubling every 2 to 3 years1 as cloud-based infrastructure revenues are expected to grow $500 billion over the next 5 years2

The US digital economy has grown $1 trillion, twice the rate of US GDP growth, from 2005-20193

Clean infrastructure is a multi-decade opportunity requiring an investment of $94 to $175 trillion until 20504

41% of consumers plan to purchase an EV as their next car5, accelerating the demand for EV infrastructure

Battery storage capacity is doubling every 2.5 years with US developers reporting a 10x growth from 2020 to 20236

BofA. “To the Moon(shots)! – Future Tech Primer” 9/14/2021

ReporterLinker. “Cloud Computing Market by Service, Deployment Model, Organization Size, Vertical and Region – Global Forecast to 2026”. October 2021

Bureau of Economic Analysis. “Updated Digital Economy Estimates – June 2021”

BNEF. “New Energy Outlook” July 2021

Ernst & Young Global. “Four in Ten Consumers Plan Electric Vehicle Purchase as Market Moves into High Gear” 7/20/2021

EIA. “Battery Storage in the Unites States: An Update on Market Trends” August 2021

Strategy Overview

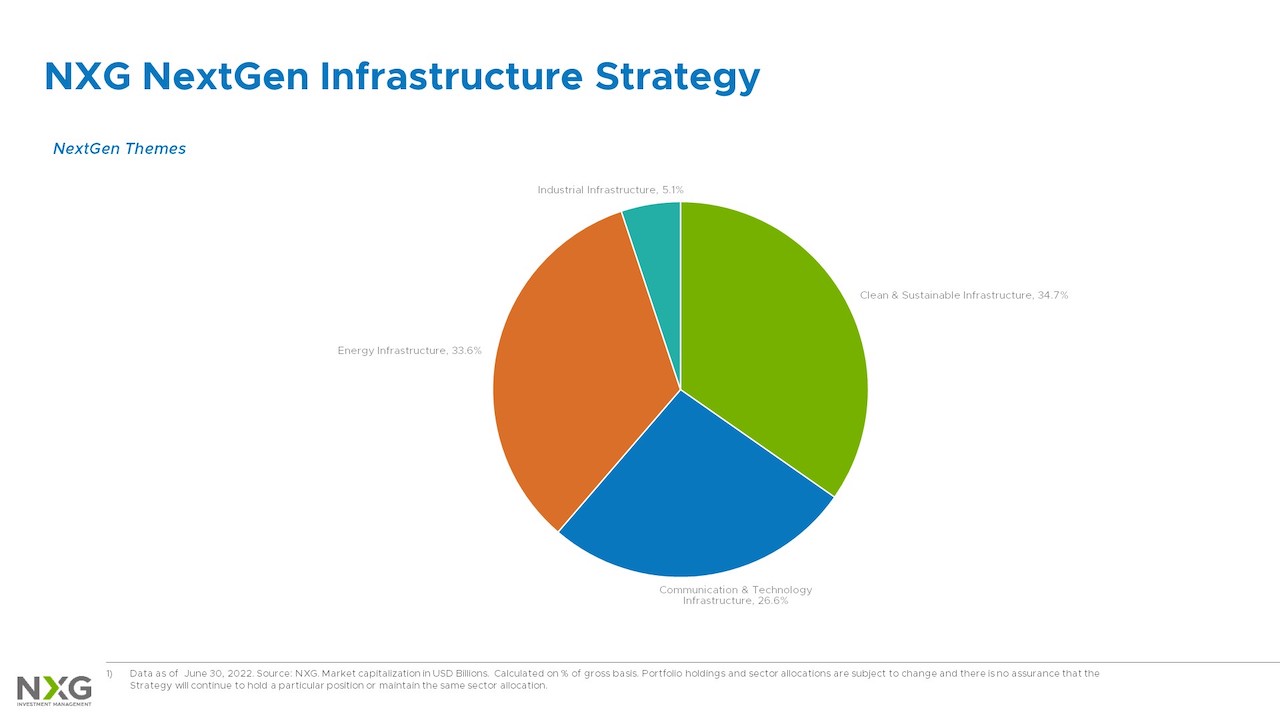

The NXG NextGen Infrastructure strategy invests in publicly traded companies throughout the world across four critical Infrastructure investment themes:

Clean & Sustainable Infrastructure

-

Renewable Energy Infrastructure

-

Electric Vehicle Infrastructure

-

Hydrogen Infrastructure

-

Water Infrastructure

-

Waste Infrastructure

-

Emerging Infra Verticles

Communication & Technology Infrastructure

-

Data Storage Infrastructure

-

Wireline Infrastructure

-

wireless Infrastructure

-

Communication Infrastructure

-

Cloud Infrastructure

-

Emerging Infra Verticles

Energy Infrastructure

-

Midstream Energy

-

Transmission Infrastructure

-

Electricity Generation Infrastructure

-

Natural Gas Distribution Infrastructure

Industrial Infrastructure

-

Toll Road Infrastructure

-

Port Infrastructure

-

Airport Infrastructure

-

Railroad Infrastructure

-

Engineering Infrastructure

Quick Facts

Inception Date

February 1, 2019

Target Number of Holdings

30 to 60

Target Maximum Position Size

<5%

Target Cash Position

<5%

Target Annual Turnover

~20% to 60%

Investable Universe1

682 Companies

$17.2 Trillion market cap

Benchmark

S&P Global Infrastructure Index TR Net

Source Bloomberg. Total addressable market data as of March 31, 2022

Portfolio Managers

Investment Vehicles

The NXG NextGen Infrastructure strategy is available in a variety of investment vehicles for institutional, retail, registered investment advisors, and family offices. Please Contact Us for more information.