NXG Global Clean Equity Strategy

Why Clean / Overview / Quick Facts / Positioning / Portfolio Managers / Investment Vehicles / Materials

Why Invest in Clean

Climate change must be addressed and acted upon

Average global temperature may rise 3 degrees by 2100, causing major changes to all types of plant and human life 1

Sea levels could rise by >15 inches by 2100, making the lives of 1.42 billion people vulnerable 2

The combination of climate warming and ocean acidification could slow coral growth by nearly 50% by 2050, severely reducing marine life 1

Climate change-related cost to human life is very high

90% of the world’s population breathes polluted air 3

Extreme weather events in the US over the past five years have caused $744 billion in damage 4

Opportunity in Clean Investing

Multi Decade Opportunity - Required investment of $94-175 trillion until 2050 5

Accelerating Growth - $755 billion spent on energy transition in 2021, up 27% from 2020 6

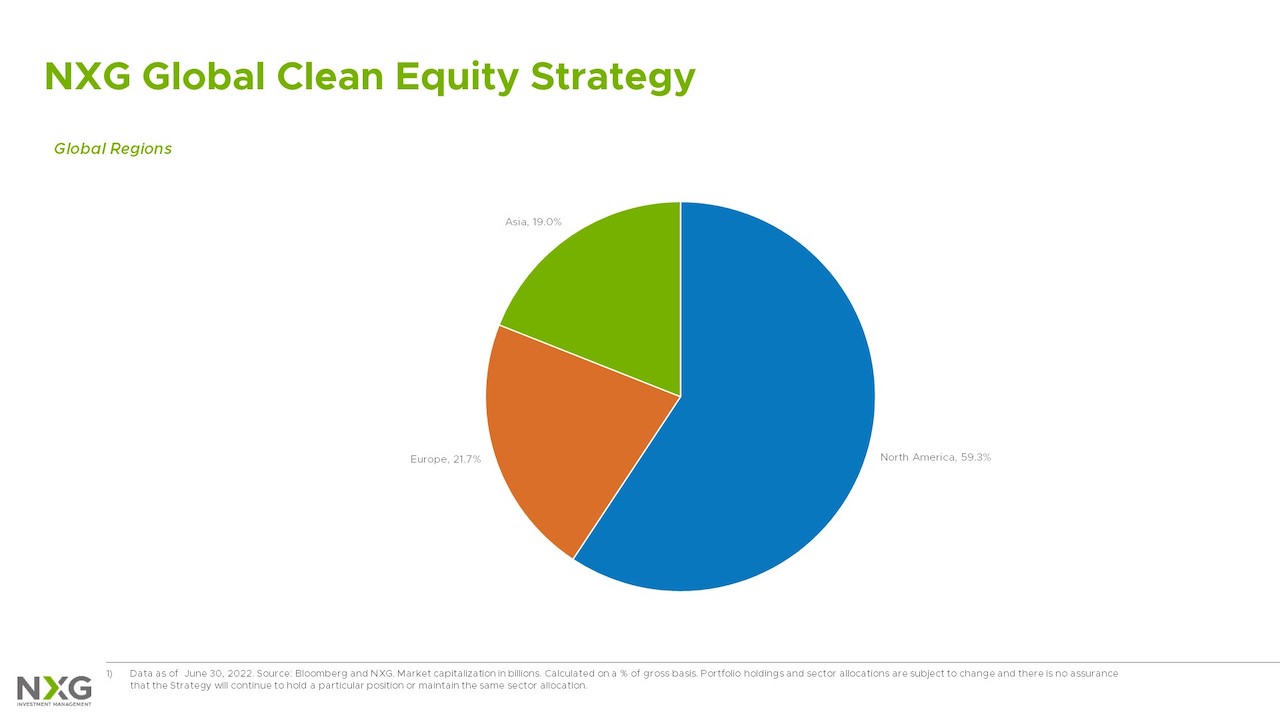

A Global Phenomenon - 80% of investment is outside of Americas, 89% of Global greenhouse gas emissions are covered by national net-zero targets 6

The demand for clean solutions spans many themes, not just one such as electric vehicles

Demand is Driving Clean Investing

Corporate Demand

355 companies have committed to go 100% renewable; these companies have over $6 trillion in revenues and have electricity demand that is greater than the UK 7

Investors controlling 37% of global AUM ($41 trillion) from 457 managers have urged governments to reduce emissions by 45% in 2030 and be net zero by 2050 8

Consumer Demand

Approximately 2/3 of global population is represented by Gen Z, Millennials and Gen X 9

As the global population ages, Millennials stand to inherit $24 trillion over the next 15 years 10

The majority of Millennials and Gen Z see ESG as top or important priority when making an investment 11

Approximately 75% of Millennials believe their investment can influence climate change and 84% believe their investments can help lift people out of poverty 10

University of Chicago, EPA. “Future of Climate Change”

NASA. “Emissions Could Add 15 Inches to Sea Level by 2100, NASA-led Study Finds” 9/17/2020

IEA. “World Energy Outlook 2021” October 2021

NOAA. “Billion-Dollar Weather and Climate Disasters” As of 2021

BNEF. “New Energy Outlook” July 2021

BNEF “Energy Transition Investment Trends 2022” 1/27/2022

BNEF. “1H 2022 Corporate Energy Market Outlook” 1/31/2022; RE100 press release. “Business demand for renewables greater than total energy demand of major G7 economies” 6/24/2021

United Nations Framework Convention on Climate Change press release 6/11/2021

Bank of America Merrill Lynch (BAML). “Transforming World – The Next 5 Years.” 6/8/2021

Credit Suisse. “Making an Impact: Earning Returns on Sustainable Terms.” 2019 Second Quarter Corporate Insights

Bank of America Merrill Lynch. “Climate Wars” 2/2/2021

Strategy Overview

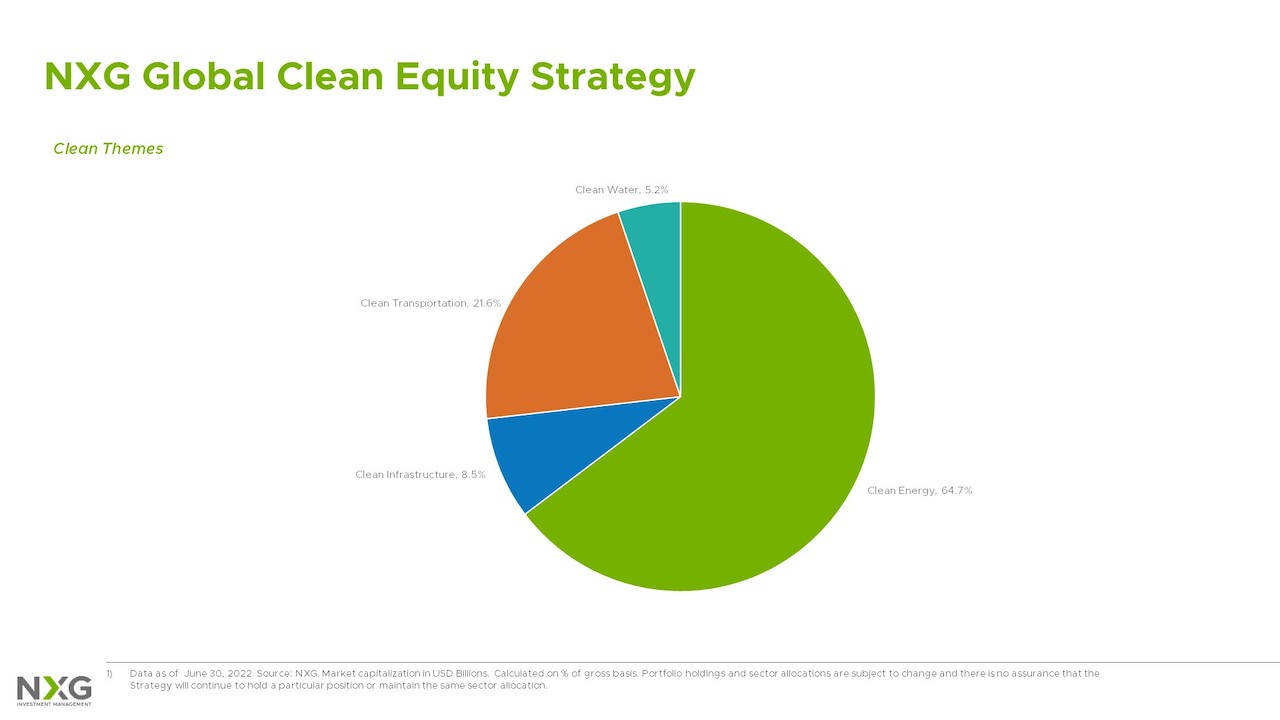

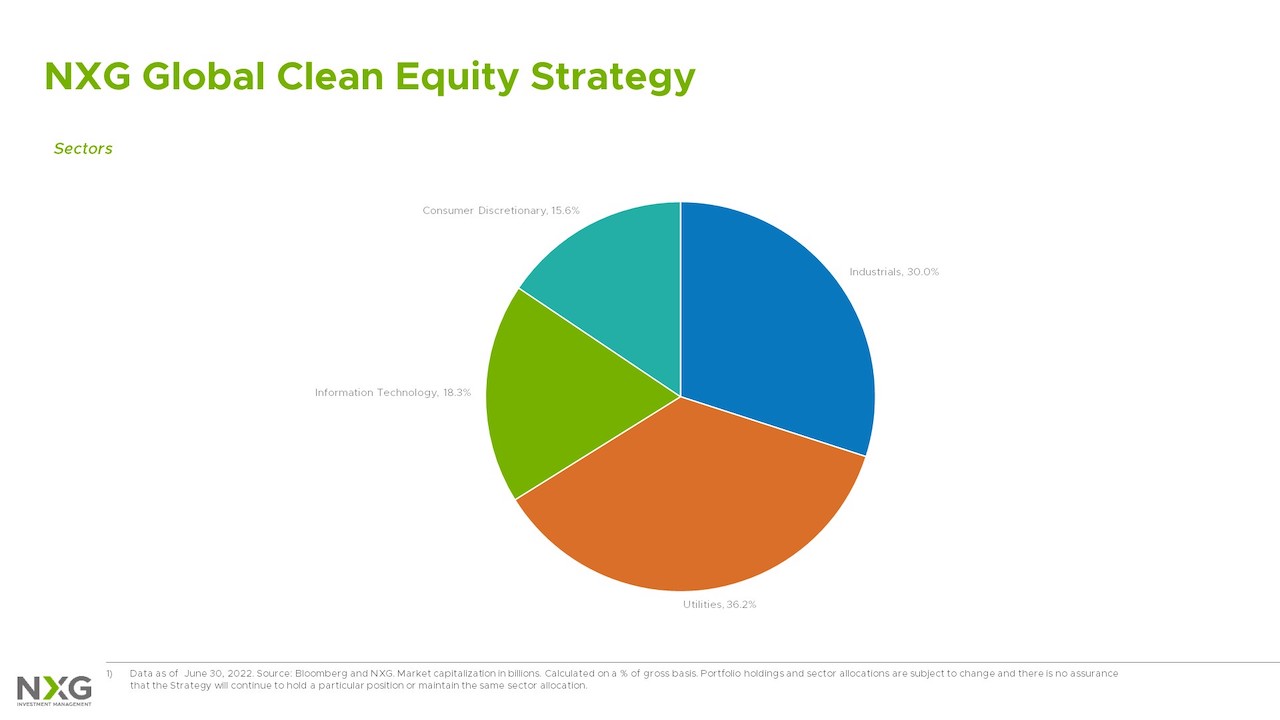

The NXG Global Clean Equity strategy invests in publicly traded companies throughout the world across four critical Clean investment themes:

Clean Energy

Clean Energy

-

Wind Energy

-

Solar Energy

-

Other Renewables & Technologies

Clean Infrastructure

Clean Infrastructure

-

Transmission & Distribution

-

Smart Grid & Smart Cities

-

Enabling Technologies

Clean Transportation

Clean Transportation

-

Electric & Connected Vehicles

-

Future Mobility & Autonomous

-

Battery & Technologies

Clean Water

Clean Water

-

Treatment & Technology

-

Management

-

Infrastructure

Quick Facts

Inception Date

January 1, 2018

Target Number of Holdings

30 to 50

Target Maximum Position Size

8%

Target Cash Position

<5%

Target Annual Turnover

~20% to 60%

Investable Universe 1

468 Companies

$6.0 Trillion market cap

Benchmark

MSCI ACWI Net TR USD Index

Source Bloomberg. Total addressable market data as of June 30, 2022

Portfolio Managers

Investment Vehicles

The NXG Global Clean Equity strategy is available in a variety of investment vehicles for institutional, retail, registered investment advisors, and family offices. Please contact us for more information.